You’ve made it -- but the complexity that comes with wealth can lead to blind spots.

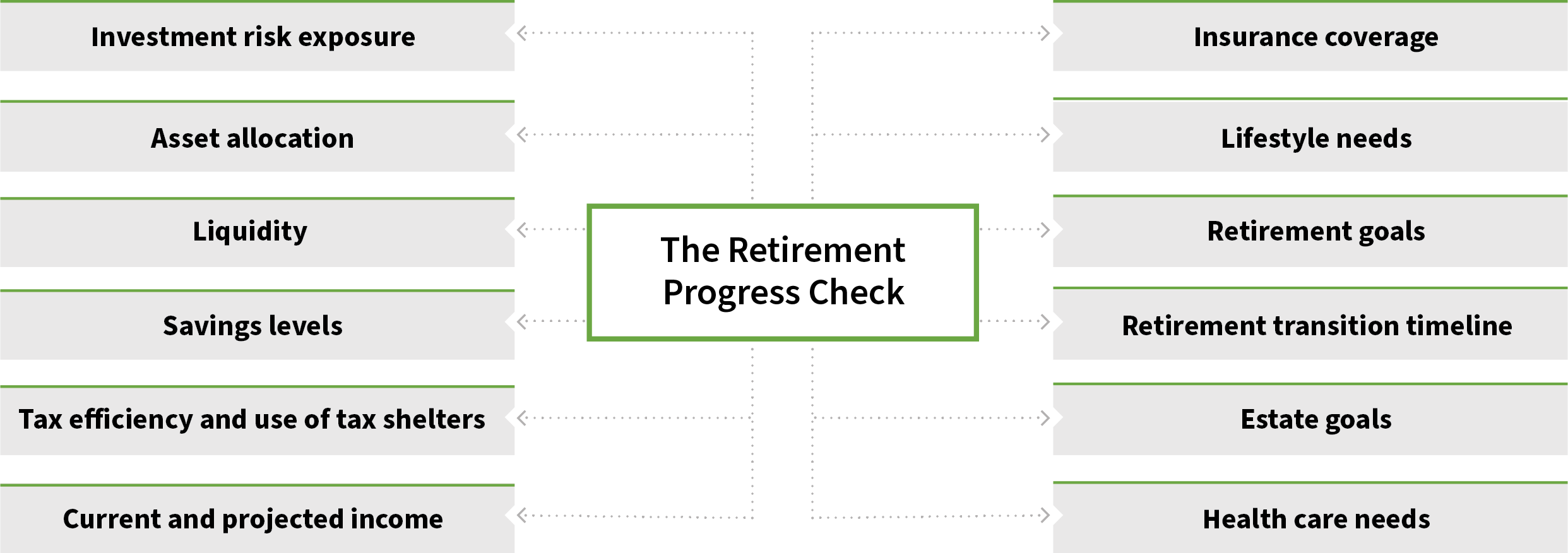

The Retirement Progress Check is our process to evaluate the assets you’ve built up over the years, and to identify any unnecessary risk, inefficiencies or redundancies that may have developed. We want to ensure you’re invested according to your risk tolerance, you’re successfully mitigating tax, and your wealth strategies are generally well-aligned with your needs.

To some degree, the investments in your portfolio are always tied to market cycles – but income is different.

We’ve seen that as you get closer to retirement, it’s important not only to consider how much investment income you’ll need to support your lifestyle, but also how that income is being generated.

“It’s easy to set up an automatic withdrawal or simple income strategy, but what happens when the market shifts? When that income enables you to live the life you want in retirement, you need to pay attention to where it's coming from and how sustainable it is.”

Today you can invest in everything under the sun and the choices can be overwhelming. Our job is to find the options that will suit you best, and we look far beyond mutual funds to do so.

Instead of pooling your money with countless other investors, our focus involves separately managed accounts and direct ownership of securities. This allows us to offer greater customization around your needs and more opportunities to help minimize cost.

Separately Managed Accounts (SMAs) may not be appropriate for all investors. SMAs may be style specific, concentrated and may be more appropriate for affluent investors who can diversify their investment portfolio across multiple investment styles.

Financial decisions are rarely about money alone -- they’re also about making ground toward meaningful personal goals.

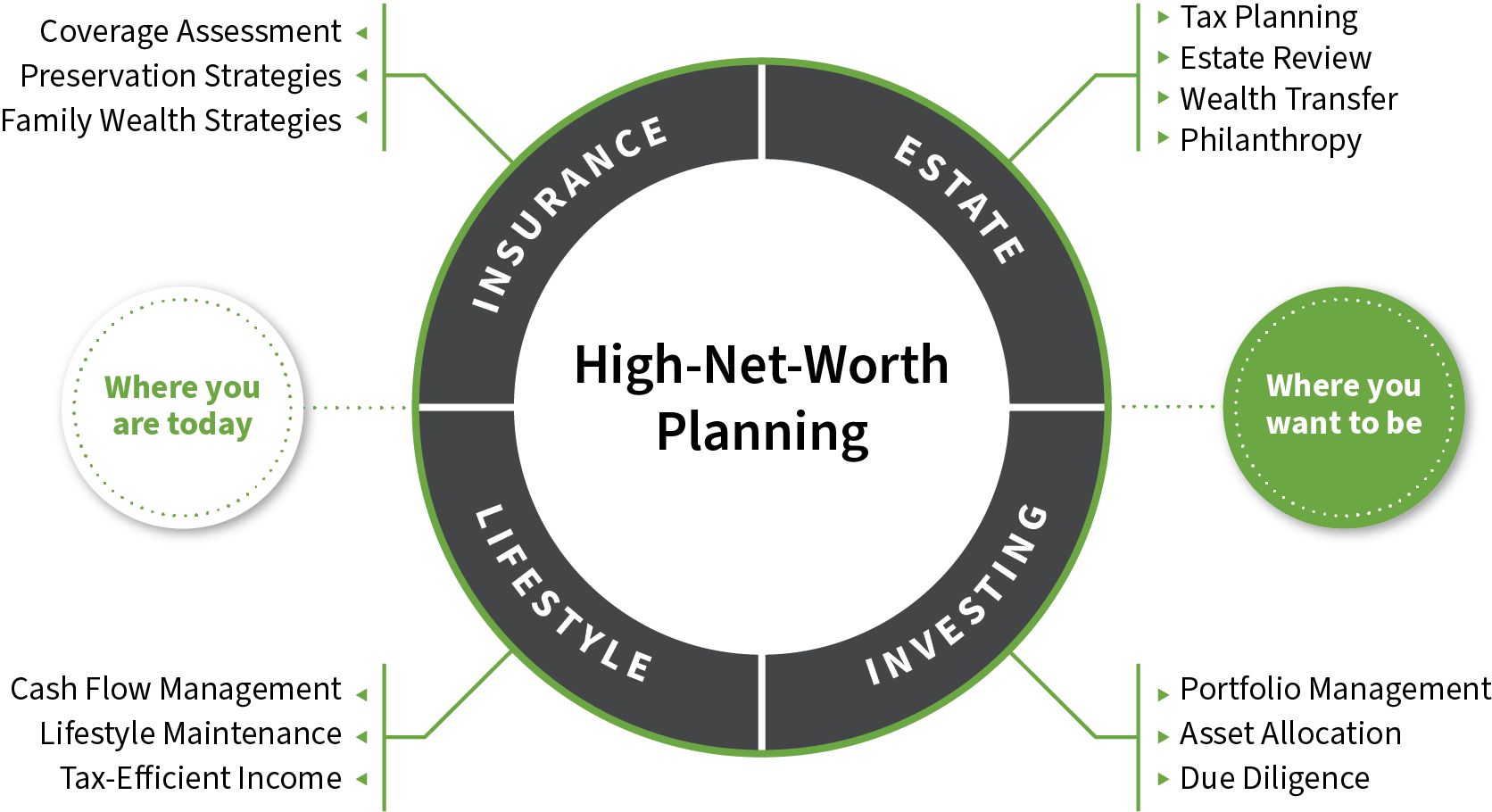

With a set of wealth planning capabilities specifically suited for high-net-worth and emerging high-net-worth individuals and families, we help ensure your wealth is working for you, your priorities and your lifestyle.

Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

Investing involves risk and you may incur a profit or loss regardless of strategy selected.